The 14.6% uptick in housing starts in January – due largely to a 77.7% increase in starts in the typically volatile multifamily sector – had the National Association of Home Builders’ chief economist, David Crowe, suggesting that the new-home market is at least stable, in spite of builders’ ongoing difficulties in obtaining credit.

Meanwhile, the NAHB/Wells Fargo Housing Market Index, a measure of builder confidence, remained essentially flat for the fourth consecutive month, prompting NAHB Chairman Bob Nielsen to echo the concerns over tight credit and declare that even though “builders are starting to see more interest among potential home buyers, we are also dealing with a multitude of challenges, including competition from foreclosure properties and inaccurate appraisals of new homes, which are limiting our ability to sell.”

Foreclosure rate to begin to shrink by the end of 2011

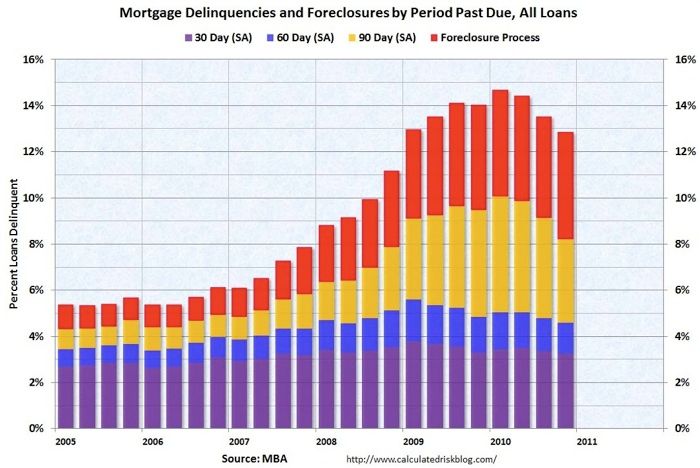

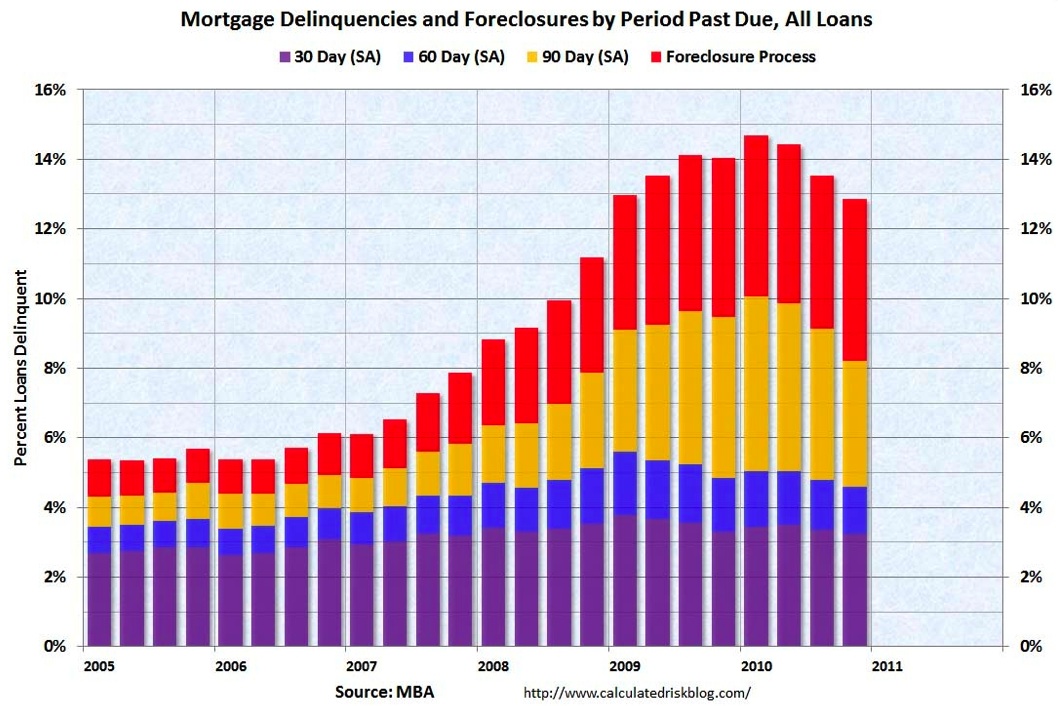

So a lot of treading water here. The foreclosure issue mentioned by Nielsen, though, took on a slightly more hopeful cast with the release this week of the Mortgage Bankers Association National Delinquency Survey, which showed that the non-seasonally adjusted delinquency rate decreased 46 basis points, to 8.93%, this quarter from 9.39% last quarter.

And while the percentage of loans in foreclosure process at the end of fourth quarter 2010 tied the all-time record, at 4.63%, up 24 basis points from the third quarter of last year and up five basis points from a year ago, the MBA points out that the surge in foreclosures reflects the expiration of foreclosure moratoriums instituted to address allegations of shoddy foreclosure paperwork.

Bill McBride, whose Calculated Risk blog focuses on finance and economics, noted that with the National Delinquency Survey covering about 88% of first-lien mortgages in the residential market – almost 50 million – its figures indicate that about 6.4 million of them are delinquent or in foreclosure. That sounds bad, and it is, but it also suggests that, as McBride puts it, “the percent of loans in the foreclosure process might have peaked (or will peak in Q1 2011).”

Remodeling shakes off its slumber

Another survey released this week added a bit more momentum to the notion that the remodeling sector is gradually rousing from sleep. The Residential BuildFax Remodeling Index rose 18% year-over-year—and for the fourteenth straight month—in December to 103.8, the highest December number since the index’s launch, in 2004, according to BuildFax, which tracks historical building permit data nationally.

Residential remodels in December were up month-over-month 0.5 points (less than 1%) from November, when the index posted at 103.3, but year-over-year they were up 15.6 points from the December 2009 index value of 88.2.

While the Northeast, Midwest, South, and West regions all but the Midwest showed year-over-year increases from December 2009 to December 2010. The Midwest and West, however, are expected in 2011 to exceed their 2006 and 2007 remodeling numbers, while the South and Northeast are expected to gain more modestly, said BuildFax’s vice president of research and development, Joe Masters Emison.

The delinquency rate for mortgage loans on residential properties of one to four units (i.e. loans at least one payment past due but not in the process of foreclosure) decreased to a seasonally adjusted rate of 8.22% of all loans outstanding as of the end of the fourth quarter of 2010, a decrease of 91 basis points from the third quarter of 2010, and a decrease of 125 basis points from a year ago, according to the Mortgage Bankers Association's recently released National Delinquency Survey. Meanwhile, the percentage of loans in the foreclosure process at the end of the fourth quarter was 4.63%, up 24 basis points from the third quarter of 2010 and up five basis points from one year ago, which the MBA says reflects the expiration of foreclosure moratorium initiatives.

View Comments

I wish I shared your optimism.

Yes, remodeling has a has a pulse, but your statistics' relevance to foreclosures is lost on me. Nearly 40% of home sales in California last month were foreclosures and banks are sitting on a vast shadowy inventory of foreclosed properties for fear that releasing them too quickly will further depress prices and submerge more homeowners.

And, witness the tens of thousands besieging the state house in Madison, Wisconsin, this week, state finances across the country are a sea of red ink.

For a less sanguine take on what's really happening in housing, you might want to check out the site of a contrarian who called the housing collapse two years before it happened. He continues to glean stories from a multitude of sources, http://patrick.net/housing/crash.html