Getting a loan for that weekend getaway house is possible, although you may find some requirements to be stiffer than for your primary home.

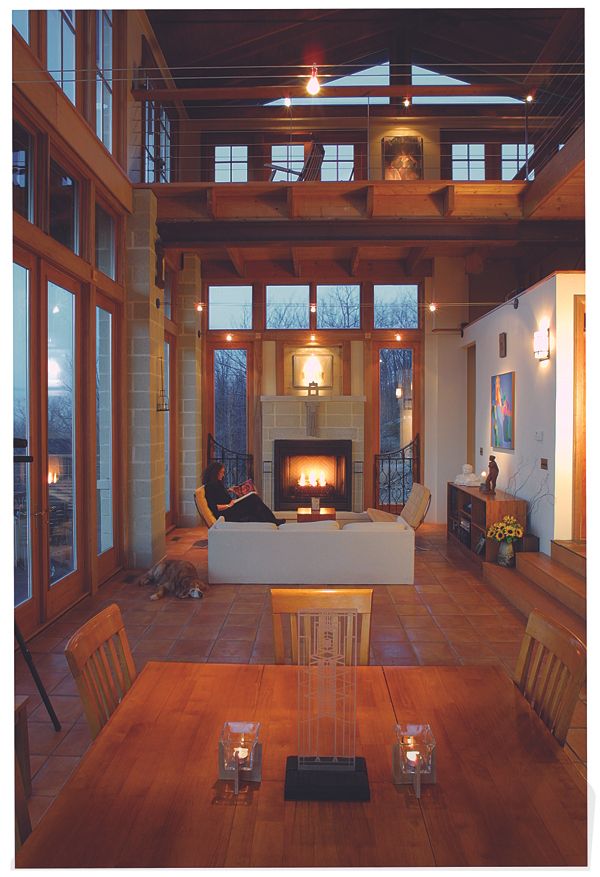

If your life during the week has you wanting to unwind in a different setting on the weekend, you may be thinking about purchasing a second home.

The application process for a mortgage on a second home is similar to that for a first-home mortgage. The borrower needs to provide the same sort of information on income and assets, and the lender needs to be confident that the borrower will be able to repay the loan. Borrowers with good credit can usually get a mortgage for a second home as long as that mortgage won’t stretch their debt-to-income ratio beyond the lender’s maximum–usually 36% of pretax income.

A second mortgage can represent a greater risk for the lender than a first mortgage, however. Think about it: If your spouse is laid off and the roof on your second home needs to be replaced, will you be able to afford the repair plus keep up with both mortgages on your salary alone? Your priority likely will be your primary residence.

With greater risk often comes a higher interest rate and more-stringent credit requirements than for a first home. One way that borrowers may be able to receive a lower interest rate for a mortgage on a second home is to assume more of the risk themselves by using equity on their first home for the down payment on their second. With more skin in the game, borrowers are more likely to do everything they can to avoid defaulting.

Keep in mind that lenders and the IRS treat second homes differently if they are considered investment homes (dependent on rental income to pay the mortgage) rather than vacation or weekend homes.

If you’re thinking about buying a second house that’s energy efficient, or if you want to make it so, consider an energy-efficient mortgage (EEM), which can enable you to borrow a larger amount because your monthly utility bills will be lower.

View Comments

We are providing Home build Mortgage services at Bedford, Texas, USA.