As we’ve noted many times before, the folks on the front lines of new-home sales – homebuilders – understand the realities of the market more acutely (and sooner) than the economists who follow the sector. But it doesn’t hurt to highlight data that lifts the gloom.

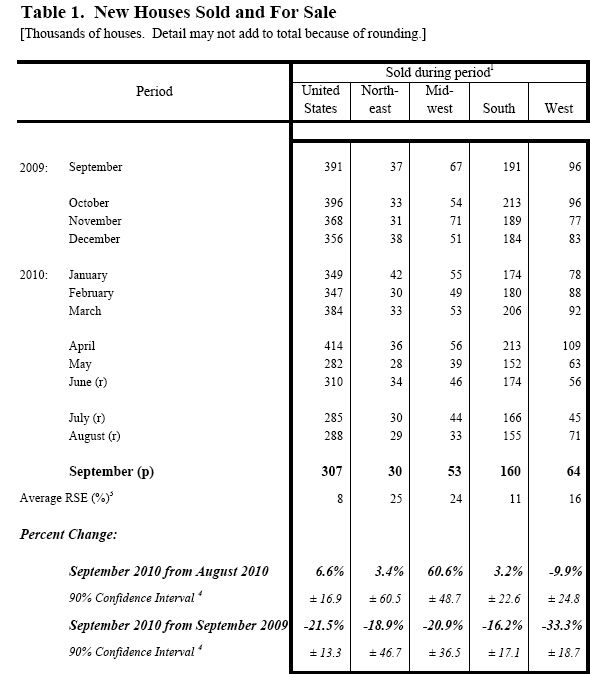

Two readings emerged over the past week: there was an uptick of 6.6% in new-homes sales in September over August, according to Department of Commerce figures, and the Conference Board Consumer Confidence Index, based on a survey of 5,000 U.S. households, inched up in October to 50.2 from 48.6 in September. Existing-home sales also nosed up in September, by 10%, but remain almost 20% percent off the pace set in September 2009, according to the National Association of Realtors.

Foreclosure documentation’s strange chemistry

Compared to the low-energy proceedings of summer, fall is turning out to be at least brighter, if not blistering. From the perspective of the National Association of Home Builders, the new-home sales bump in September, which includes a seasonally adjusted annual rate of 307,000 units (the best pace since June), would have delivered more bounce if credit for new-home construction were more available. As builders slim their inventories, a lingering concern, says the association’s chief economist, David Crowe, is that credit stinginess, and its effects on builder attempts to balance inventory with potentially growing demand, could dampen “positive momentum” in the market.

Even though September’s positive numbers – boosted largely by a 60.6% climb in the Midwest, but tempered by a 9.9% drop in the West – are hardly enough to bolster investor confidence in homebuilders stocks, they come along at a time when faulty foreclosure documentation is starting to raise concerns among prospective homebuyers who might otherwise prefer distressed properties over new homes.

So while builders have been understandably reluctant to increase construction until more foreclosed properties have cleared off the market, the possibility of a contested or canceled sale due to an invalid foreclosure could steer more buyers to new homes, Brad Hunter, chief economist with real estate research specialist Metrostudy, told the Associated Press this week.

Too early to tell, of course, what the long-term effects of the foreclosure-documentation mess will be, or whether it will linger long enough to cause major disruption in the new-home market, but it’s an interesting point.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

8067 All-Weather Flashing Tape

Affordable IR Camera

Reliable Crimp Connectors

A chart detail of Department of Commerce new-home sales figures for 2009 and 2010, through September.