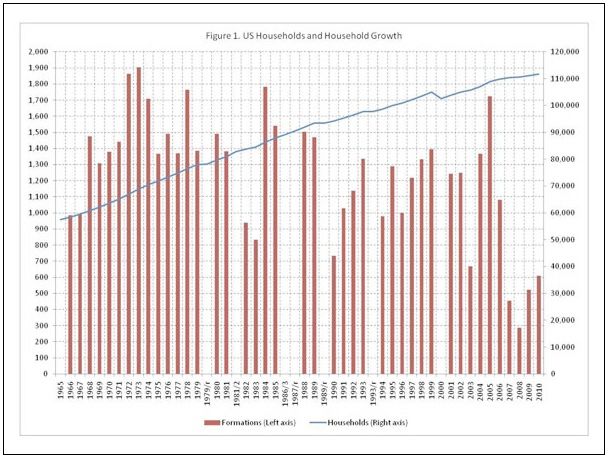

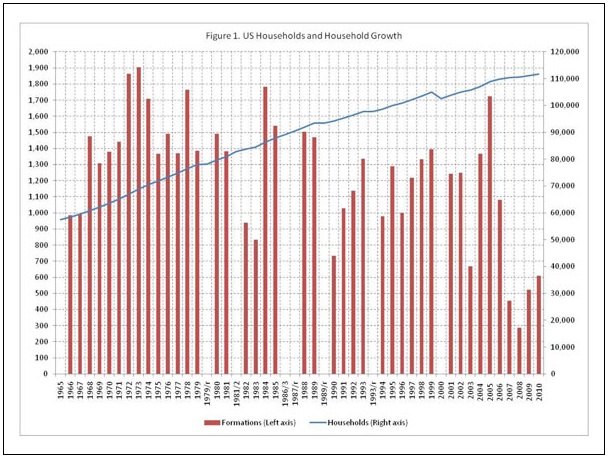

The National Association of Home Builders recently fired yet another salvo in its assault on tight credit for homebuilders, this time with an NAHB study indicating that household formations, which were delayed from 2007 to 2009 because of the recession, would soon resume and, consequently, create enough demand to absorb much of the existing inventory and help revitalize the market for new homes.

NAHB points out that that process will unfold smoothly only if adequate credit is available, giving builders the resources and time to properly plan construction of both single-family and multifamily housing to meet demand that has been “pent up” by the generally poor economic conditions that prompted many young people – including offspring of the large baby boom generation – to double up with roommates or live with their parents until the economy improved.

“A considerable portion of the excess housing supply is due to a steep decline in demand related to economic conditions, rather than due purely to overbuilding,” the study says. “This has important implications for recovery in the housing market.”

Delayed household formations

Household formations grew at about 1% annually from 2000 to 2007, then declined to 421,000 annually during the recession, from 2007 to 2009, delaying about 2.1 million household formations that would have occurred had the formation rate continued at its pre-recession pace. Those delayed household formations, the study notes, account for two-thirds of the market’s excess housing units, which number about 3 million, according to one estimate.

The study concludes that the excess supply of housing – a result of both the economic malaise and overbuilding – “reflects or embodies significant pent-up demand, implying that recovery in the housing market will come more quickly as the economic recovery makes progress and pent-up demand turns into realized demand, absorbing vacant units in the existing stock and adding pressure for the construction of new units.”

A forecaster’s paradise

This analysis of pent-up demand does require a relatively long-term perspective on the prospects for the housing market, and isn’t necessarily at odds with the recent crossfire of market predictions for the coming 24 months. As of Tuesday, those predictions ranged from “nowhere to go but up” to “expect more of a drop.” The housing formation analysis also seems compatible with the forecast offered last month by Fannie Mae’s chief economist, Doug Duncan, who said in a podcast summary that while the market in 2011 is expected to improve modestly, that improvement will set the stage for a gradually more robust revival over the next three years.

Look for “a better year in 2011, a firmer base for the recovery – or for the expansion – than in 2010,” Duncan said, but expect to wait for robust growth for at least another year and a “return to normalcy out in 2014.”

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Reliable Crimp Connectors

8067 All-Weather Flashing Tape

Affordable IR Camera

Household formations, which help precipitate housing demand, tend to increase when the economy is strong and decline when the economy is weak, as they did in the recession years of 1982, 1983, and 1990, and, following steep stock market declines, in 2003. A recent NAHB study calculates that 2.1 million household formations were delayed from 2007 to 2009 because of the most recent recession. As economic conditions improve, household formations, including those among the offspring of the huge baby boom generation, are expected to accelerate.