Distressed Property Opportunities

Whatever recovery rates prevail for the housing market and overall economy over the next 10 years, remodelers and their suppliers likely won’t see extremes of the sort that characterized the industry since 2000, an analysis prepared by the Joint Center for Housing Studies of Harvard University shows. Instead, the growth of home improvement spending is expected to resemble that of the late 1990s, when expenditures increased 5% to 6% annually.

The outlook, in other words, is for stability. In addition, that stability will be accompanied by new opportunities in the market, especially as foreclosed properties find buyers, homeowners who have committed to staying in place prepare their homes for the long term, immigrant households increase their remodeling expenditures, and energy costs drive up interest in energy efficiency retrofits, the JCHS analysis, “A New Decade of Growth for Remodeling,” indicates.

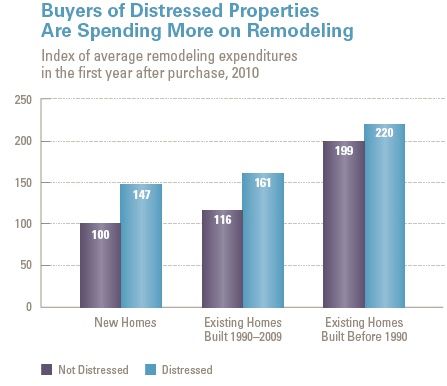

Pent-up demand for distressed-property repairs

With mortgage delinquencies accounting for almost 8% of total mortgages nationally (roughly six times higher than is typical in a healthy market), foreclosed properties are going to be a significant feature of the real estate landscape for some time. The distressed-property inventory during the third quarter of 2010 accounted for 25% of residential sales, the JCHS notes, citing RealtyTrac reports. But when these homes, which linger unattended for 500 days on average, do eventually find owners, they often need substantial repair work.

Reduced mobility’s silver lining

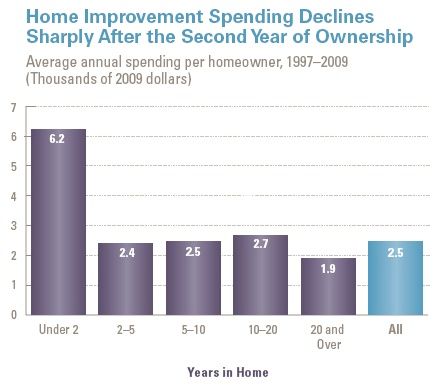

One trend that’s expected to continue: declines in homeowner mobility. The tendency of homeowners to sell so they can buy a more desirable home has been declining since 1985, JCHS points out, citing Census Bureau figures showing the national mover rate in 2008 at 11.9% – the lowest rate recorded by the agency since it began tracking mobility in 1948.

Certainly some of the factors slowing mobility, including an increase in “underwater” inventory, are unlikely to favor home improvement spending. But other factors that can curtail mobility, such as stricter lending criteria, declining prices, and eventual mortgage rate increases, are expected to encourage homeowners to stay where they are and invest in practical improvements that enhance the performance and longevity of the dwelling.

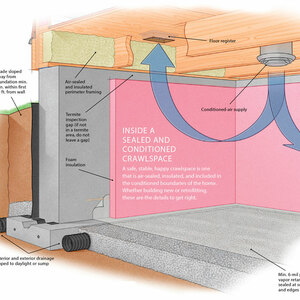

Many homeowners who have managed to acquire financing at low rates, for example, will be less likely to trade up if, as rates climb, they’ll be forced to take on more-expensive financing in the process. Their commitment to staying put – the JCHS analysis calls it “mortgage lock-in effect” – typically prompts interest in upgrades that make sense for the longer term: a roof replacement rather than a patch, installation of a more efficient HVAC system or better-performing windows, or an insulation upgrade and new siding.

Shifts in domestic migration and new growth categories

As might be expected, household-income levels in metropolitan areas that saw booms in domestic migration and overbuilding in the 2000s – such as Orlando and Jacksonville in Florida, as well as Riverside, California, and Las Vegas – are expected to be less active remodeling markets (except for foreclosure repairs) than those in the Northeast, Midwest, and even in some West Coast cities, where domestic migration losses after 2009 were not as severe as those in the Sunbelt.

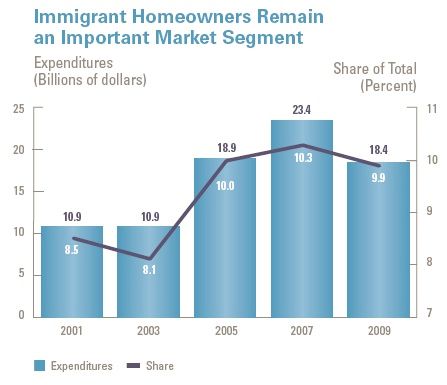

The JCHS analysis does point to one emerging-market niche that is growing in urban and suburban markets in all parts of the country: immigrant households, which, the study shows, more than doubled their remodeling expenditures between 2003 and 2007. Although these households cut back during the recession, they are expected to account for almost 20% of household growth from 2020 through 2025, according to JCHS projections based on Census Bureau data.

The other remodeling niche expected to see significant growth will be energy efficiency retrofits and other green-improvement projects, which accounted for 25% of all projects in early 2009 and 28% in the second half of 2010, according to JCHS National Green Remodeling Survey figures. Federal and local tax incentives and subsidies drove much of this activity, with contractors reporting work on tax-credit-eligible projects increasing from 40% in 2009 to 60% in mid-2010. The focus of this work tended to be on building envelope improvements, including window and exterior-door replacements. Fewer than half of the projects involved HVAC upgrades or replacements, and a small number focused on installations of renewable-energy systems, the survey found.

More in this Series:

Even with Recent Declines, the Remodeling Market is Nearly $300 Billion