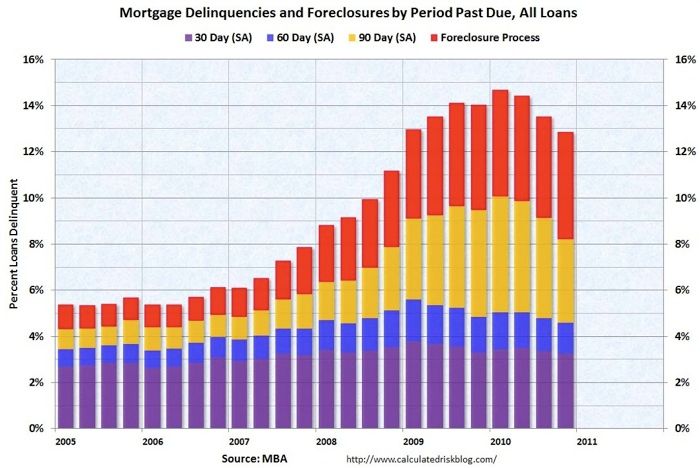

It would be hard to predict how many of the 4 million households heading for foreclosure would be candidates for renegotiation of their loans by mortgage-servicing departments of the banks that originated the loans. Even if it’s a relatively small percentage, though, it seems to many housing market observers (including many homebuilders) that it would be an option worth pursuing if it prevented even 100,000 foreclosed homes from hitting the market and further diluting property values.

The Wall Street Journal and the New York Times both published stories this week in advance of soon-to-be-announced legal agreements between federal regulators (including the Office of the Comptroller of the Currency and the Federal Reserve) and mortgage servicers. Both stories give space to critics of the new rules. Consumer advocates and banking industry watchdogs, for example, say they worry that the focus of the agreements will be on making the foreclosure process more orderly, legally compliant, and transparent, to the exclusion of compelling servicers to negotiate mortgage modifications that would keep borrowers in their homes.

States still trying to carve their own path

But as both stories note, state attorneys general have been pursuing agreements of their own with the banks, and in most cases they are pushing harder to get banks to not only clean up their act on the processing side but also pursue mortgage modifications more seriously. It is a tough row to hoe, particularly because banks sold the loans, before they became delinquent, to investors. Absent strong financial motivation, banks are going to fight meaningful mortgage-modification measures with plenty of their own legal firepower.

One observer told the Times that the federal regulators’ agreements might not only prove to be too meager, but also prove to be destructive for borrowers – and the housing market. “It gives the banks political cover, undermines attempts at a real and just resolution, and could be the basis for the regulators to claim that state actions are pre-empted,” said Adam Levitin, an associate professor of law at Georgetown University.

But Shaun Donovan, the secretary of Housing and Urban Development, told the Journal that the legal agreements forged by federal regulators should “coordinate well with the progress we’re making with the state attorneys general.” Banks will likely be given 60 days to bring their servicing procedures into compliance with federal regulators’ requirements.

Donovan did point out, however, that Federal Housing Administration examinations showed that homeowners in fact haven’t been properly evaluated for loan modifications, especially in the critical, early phases of their delinquencies. “Those steps weren’t taken in far too large a number of cases,” he said.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

8067 All-Weather Flashing Tape

Handy Heat Gun

Affordable IR Camera

Critics of federal regulators’ upcoming legal agreements with the nation’s 14 largest mortgage servicers say they’re concerned the agreements will address only the foreclosure process, and not include strong measures to force servicers to pursue loan modifications.