Most housing market observers long ago digested the notion that prices might taper off a little more or maybe flatten over the next 18 months, and they’ve grown accustomed, though not necessarily comfortable, with the market scraping the bottom of the trough.

Still, when the Standard & Poor’s/Case-Shiller Home Price Indices are published near the end of each month, they are widely cited in news reports. Presenting its data in 10-city, 20-city, and nationwide composites on a two-month lag, Case-Shiller focuses only on homes that have sold at least twice (thus excluding new homes), and applies larger weight to more expensive homes and less weight to less expensive homes, Morgan Brennan, a real estate reporter for Forbes, noted in a recent post.

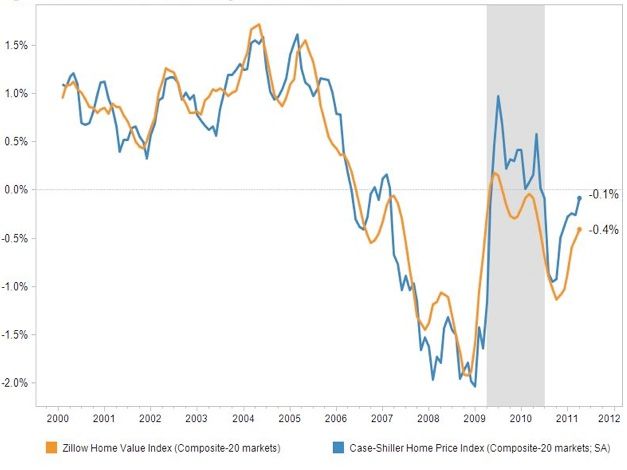

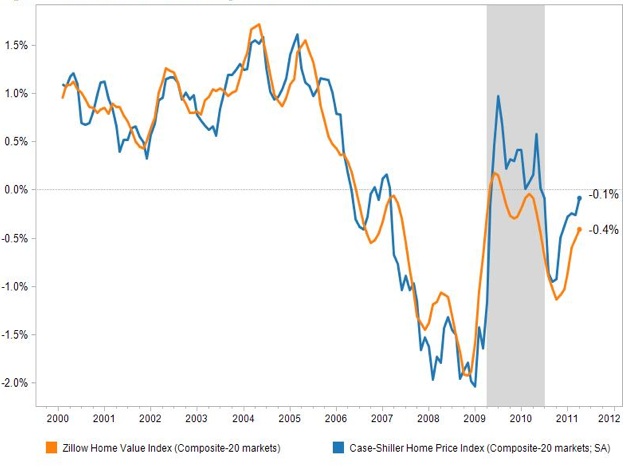

Sales trends indicated by two other widely followed indices – the Zillow Home Value Index and Clear Capital’s Home Data Index – are broadly similar to those tracked by Case-Shiller, but there are significant differences in the details. Zillow, which reports monthly on a market lag of about six weeks and covers all types of residential sales in 200 markets, tracks median prices. The Home Data Index, also published monthly, includes pricing data current to the week before the index is published, but tracks activity in several hundred metropolitan services areas as well as smaller communities.

Which is the one to watch? Depends on your appetite for tracking the market. Case-Shiller will continue to be the index often cited in news reports, and Zillow won’t be far behind in that realm, although, as Brenner points out, it is the service consumers likely will find most helpful. Home Data Index subscribers will continue to be for housing industry professionals who want to go deep into the numbers.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Reliable Crimp Connectors

Handy Heat Gun

Affordable IR Camera

Month-over-month changes in home values in the 20 metropolitan statistical areas in the S&P/Case-Shiller Composite 20 Index, as tracked by both the Zillow Home Value Index and S&P/Case-Shiller, seasonally adjusted. While both indexes show broadly similar patterns, says Zillow chief economist Stan Humphries, Case-Shiller has been more positive since 2009 in part because it reflects a relatively large volume of foreclosed homes that initially sold at deep discounts and then sold later at prices closer to market value. Details of Humphries' perspective on Case-Shiller can be found here: http://www.zillow.com/blog/research/2011/06/28/for-an-accurate-picture-of-the-market-case-shillers-non-seasonally-adjusted-monthly-numbers-wont-cut-it/

View Comments

As long as the media cites Case Shiller which is prejudiced by foreclosures and the limited markets included they will continue to present a distorted picture of the housing industry. Looking at CoreLogic's index which excludes foreclosures shows a housing market where non-distressed housing prices have stabilized across the country and, in most markets, are moving upwards.

Besides, all housing values and markets are local and there are many markets throughout the country that are healthy and prospering.

It is time for the media to stop beating uo on housingand recognize that the recovery is taking place, albeit at a slower pace than might be newsworthy. Honesty in the media, which in this case would equal positive news on housing, would help to boost consumer confidence and benefit everyone.

http://www.residentialmarketingblog.com

Figures don't lie, but liars can figure!

"Sold closer to market value" THERE'S the problem. The sale price IS the market value. Any other 'value' is pure eyewash, pure speculation. Money talks, BS walks.

"Distressed prices." How about saying 'sanity restored to wildly inflated prices?' Think about just how thin the line is between 'reporting' and 'editorial.'

Recovery? Wishful thinking. As most recently illustrated by the bursting of the housing bubble, it takes a good two years of data AFTER something happens before you can say for sure that it happened. There's simply no way to say something is happening now.

Nor is there any reason to apply a general trend to specific situations. To illustrate the point, look at the 'general trends' and contrast it with the employment booms and housing shortages in oil and mining districts. Someone forgot to tell Elko and Minot that there was a recession happening.

Market value?

Still a buyers market, Houses for sale now at 300k that were 600k, and you could not buy the property and build the house for 600k. Those homes have not been foreclosed on.

The market has always been fluctuating all this while whether it is in the residential sector or commercial side. Prices plunge one day, and suddenly spike back up on another. It has been highly essential for anyone interested to make a purchase to carefully study the market pattern before clinching any deal. I did the same with my homework and research before landing with the perfect location for my self storage which I currently manage. It all takes some effort to go a long way.