Passivhaus Apartment Complex Would Be a Giant

When ready for occupancy in early 2017, the riverfront apartment complex would be the largest Passivhaus-certified building in the country and, according to its developer, help Passivhaus construction shed its “boutique” status and begin to interest big institutional investors.

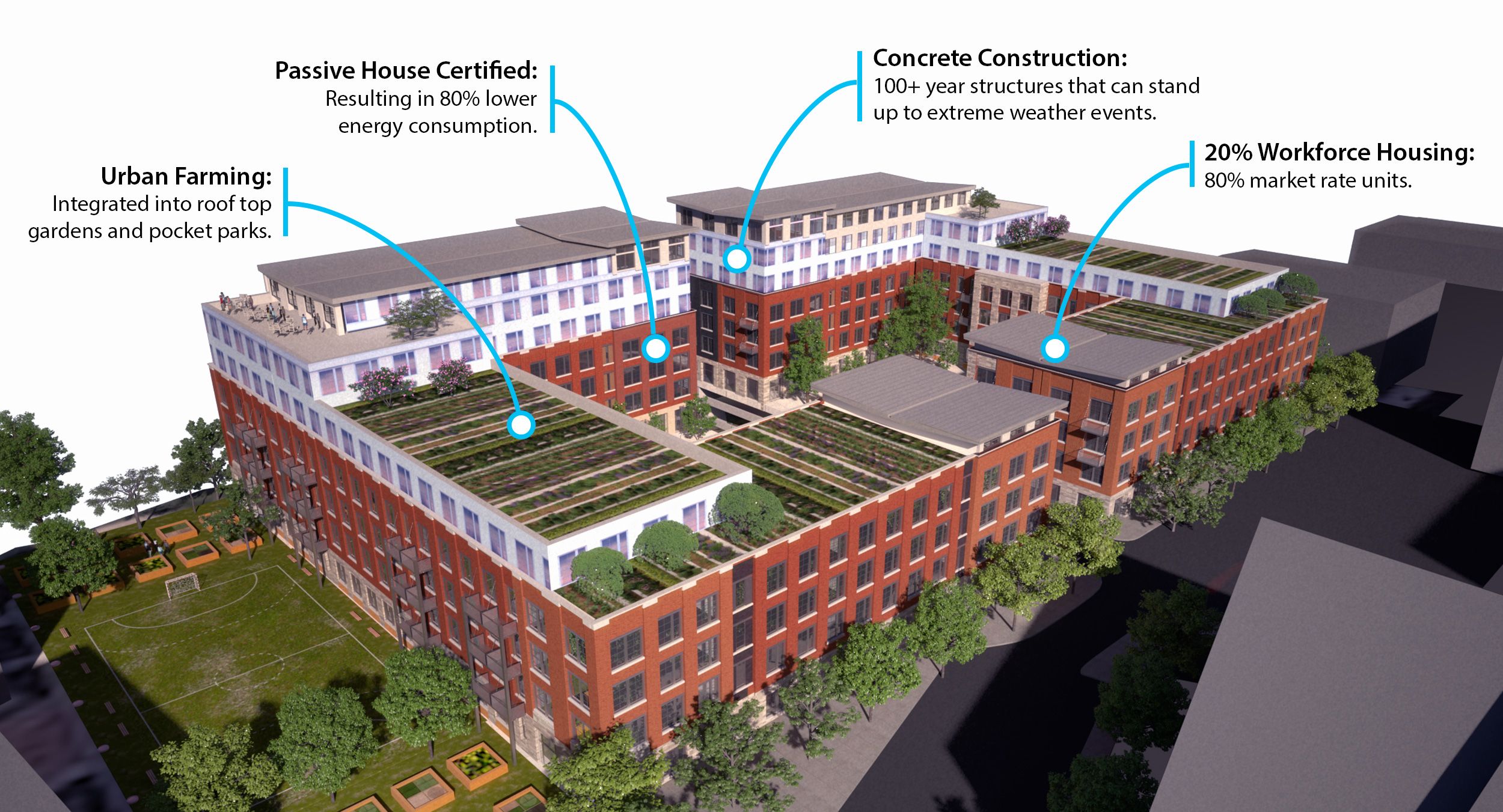

The “Second and Delaware” project, named for its location in an historic warehouse district just north of downtown Kansas City, Mo., will include a range of apartment sizes, from 550-sq.-ft. studios to 1300-sq.-ft. two-bedroom models. It also will feature rooftop gardens and an underground, 500-vehicle parking garage.

The $60 million project is the work of the Arnold Development Group, which hopes to show that projects that are good for the environment and for the people who live in them also can have an attractive bottom line. It would dwarf what is now the largest Passivhaus project in North America, the 57-unit Orchards at Orenco in Hillsboro, Ore.

Company founder and CEO Jonathan Arnold said by telephone the Kansas City project is an effort to construct a building that will last hundreds of years, “amortizing” the carbon footprint of construction over a very long time frame. He hopes it will convince institutional investors, which now buy most big multifamily projects in the country, that structures built to the Passivhaus standard are better long-term investments than less expensive buildings with lower initial costs but lower life expectancies.

Arnold Development will seek certification through the Passive House Institute U.S. (PHIUS).

Insulated concrete walls 16 in. thick

The apartments will be built around a central courtyard, the south-facing walls four stories tall and those on the north side stepped up to as much as six stories high. Unlike a “Texas doughnut” multifamily design that places outward-looking apartments around a core parking area, this project will enhance a sense of community with open space where residents can gather.

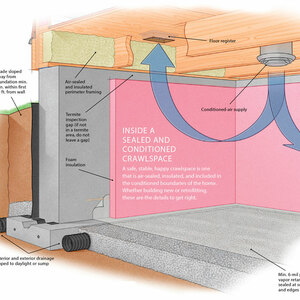

The exterior walls will be what Arnold called a “concrete sandwich wall” consisting of a 6-in.-thick wythe on the outside, a 4-in.-thick wythe on the outside and a 6-in. layer of expanded polystyrene foam insulation in the middle. Inner and outer layers of concrete will be connected with fiberglass ties placed every 18 in. The ties, Arnold said, have very high tensile strength and a low potential for thermal bridging.

Wall insulation will run continuously up to the parapet level to meet the tapered rigid insulation in the roof, which will vary in thickness from 12 in. to 15 in. Original plans called for polyiso insulation in the roof, but Arnold said that could be changed in favor of extruded polystyrene.

The buildings will be constructed with an innovative concrete-forming technique in which walls, floor slabs and columns are poured as a monolithic unit. The aluminum forms made by Western Forms are engineered for this specific job and can be assembled two to five times faster than conventional concrete forms, Arnold said, helping to lower construction costs.

With the monolithic concrete pours and continuous insulation, he said, the building achieves what Passivhaus certification requires — a continuous, non-thermal bridging insulation layer and, thanks to the concrete, very low levels of air leakage.

A “structural grid system” designed for the project by its structural engineers includes concrete columns on roughly 30-ft. centers, allowing interior walls that are not load-bearing. On the first floor, Arnold said, this design would permit a change in use from residential to something else–an urgent care center, for example–at some point in the future without changing the structure of the building.

“Some of this started with a trip to Rome and looking at the Parthenon and saying, ‘This building has been around for 2000 years, practically,'” Arnold said. “‘This is really incredible. Imagine if we could make a flexible structure that, if maintained, could last a very long time.”

Renewable energy in the mix

Staengl Engineering estimates monthly utility bills for tenants will range from $17.24 for someone living in a 550-sq.-ft. studio to a high of $40.76 for a 1300-sq.-ft. apartment. Energy consumption would be 235kwh and 555kwh respectively.

Heating and cooling will be provided by a variable refrigerant flow (VRF) system with an energy recovery ventilator located at each floor level. Domestic hot water will be produced by a Capstone Microturbine running on natural gas.

Triple-paned windows will have a whole unit U-value of 0.14 and a solar heat gain coefficient of 0.4, according to Staengl’s report.

The project is to have a photovoltaic array on the top of each of the two C-shaped buildings, for a total rated capacity of 150kw.

Galen Staengl said by telephone that while the R-value of the exterior wall (R-23) seems low for a Passivhaus structure, the building has a much higher ratio of interior space to wall than a single-family building would have.

“The more interesting thing is that in multifamily buildings, with a good surface to volume ratio, the insulation levels that are required are much lower than a single-family residence purely because of that improved surface to volume ratio,” he said.

“Passivhaus requirements are envelope requirements,” he continued. “There’s an envelope load requirement but it’s a per-square-foot number, and so in a big multifamily building where you have a very advantageous surface to volume ratio, there’s a lot less heat loss in general. Because you’re starting out with that advantage, the additional insulation required to get to a Passivhaus wall is much lower, and in some cases is actually approaching code on the wall.”

When building means more more than making a profit

Arnold’s work with a United Nations sustainable development project and the Rio +20 conference convinced him that some sustainable housing solutions were just too big for most nonprofits to handle. They required the financial muscle of a larger, for-profit corporation, but rules governing conventional corporations were too restrictive.

Arnold Development is a registered B Corporation, a designation which allows corporate officers to pursue projects even when they don’t necessarily maximize shareholder value. A B Corp is free to look for what Arnold called a “triple bottom line”–people, planet and profit.

Part of that formula will be the inclusion of affordable housing in the Kansas City mix; 20% of the apartments will be earmarked for people who earn 50% of the average median income in the area. And those apartments will be mixed in with those selling at market rates. “The idea is you nip gentrification in the bud,” Arnold said.

According an article in The Kansas City Star, Arnold hopes to introduce a financing plan that allows residents to build equity in the property by purchasing shares in a real estate investment trust (REIT) rather than simply paying rent.

“The REIT model has the potential to revolutionize the rental housing market by effectively turning renters into owners in the underlying real estate assets,” he told the newspaper. “Within a generation, entire neighborhoods made up of sustainable, long-lasting, multifamily housing could be ‘owner-occupied’ and debt free.”

Big enough to make a difference in the industry

Second and Delaware, which Arnold Development plans to own as well as develop, is big enough to show large, institutional investors type of construction is not only feasible but profitable. Smaller projects, those with fewer than 250 apartments, are outside the sweet spot for large investors, he said, so a meaningful shift in the housing industry will require projects that institutional investors are willing to underwrite.

“What we wanted to do was move Passivhaus out of the small boutique kind of scale,” he said. “Institutional investors–pension funds, and REITS, life insurance companies–are the ones that are buying the majority of multifamilies in the U.S. and they’re not going to buy a 100-unit project. It’s not big enough for them. Two hundred and fifty units is the low end of the sweet spot for maximizing onsite labor. If you have less than 250 units, the institutional investors have found the economies of scale aren’t there.

“If we really want to make an impact on what’s being built,” Arnold continued, “we need to build product at a scale that’s going to be attractive to their investment criteria. This is the first truly institutional-scale, institutional-investor-scale, project.”

There are also good financial reasons for embracing Passivhaus construction, he said. Although higher in cost initially, they will have lower operating costs, much lower long-term maintenance costs and will prove to be more profitable than projects that are “myopically focused on first costs.”

Read more: http://www.greenbuildingadvisor.com/blogs/dept/green-building-news%2A#ixzz3loXrCphz

Follow us: @gbadvisor on Twitter | GreenBuildingAdvisor on Facebook