WHY I’M INTERESTED

Many builders are good at calculating financial equations in their head, but mortgage calculations are a bit tougher. Many construction projects come down to finance, and being able to articulate the first costs (construction) as an ongoing cost (operating) can help make a complex project doable. While many builders send clients to a banker to figure out financing, it inevitably helps to control (or at least understand) the transaction.

WHAT IT DOES

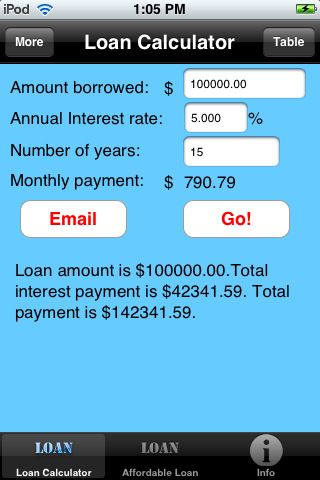

Simple Loan Calculator offers two functions: Loan Calculator which cranks out a monthly payment, and Affordable Loan, which outputs how much loan one can afford:

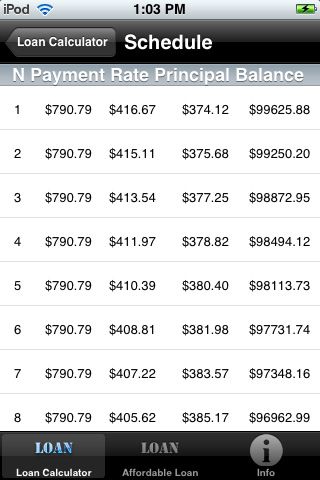

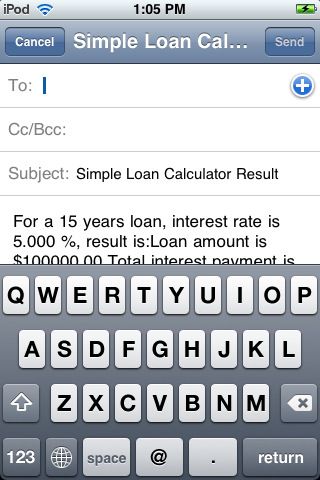

With the Loan Calculator function the Inputs are “Amount Borrowed”, “Annual Interest Rate”, and “Number of Years”, which yield outputs or Monthly Payment, Total Interest and Total Payment. The Monthly Payment is the only thing I would really need. You can easily email all this data to whomever, a banker or client. It also cranks out an Amortization table which, unfortunately, you cannot email. Say your client’s project budget comes in at $200,000, and they are conducting the traditional price-shock depression. One of the ways a designer|builder can help is to show how this breaks down into their monthly payment (at the end of the day, nearly all of us calculate the costs of homeownership on this monthly scale). At a conservative 5.5% and 30 year amortization, the project mortgage would be $1136/mo. The amortization schedule shows that they’re paying down the loan principle by about $219/mo, effectively paying themselves back, so the real cost is the interest, which starts at $917/mo and declines with each payment. The latter part being all deductible (most of our clients are in a 35% combined state & federal bracket), you can multiply it by .65, and the result is a post-deduction true costs of $596/mo. That math will either make your client’s head hurt or put them at ease. I’ve seen both.

Affordable Loan reverses the equation and calculates how much loan one can afford given inputs of: “Monthly Payment”, “Annual Interest Rate” and “Number of Years”. Outputs are “Affordable Loan”, “Total Interest and Total Payment”. Say your client knows that they need an addition for their growing family, and they have already calculated that they can afford an additional $750/mo towards their project. A designer|builder can calculate a conservative 5.5% interest rate over 30 years and conclude they can afford a $132,092 project. I’d adjust that number applicably, upward for mortgage interest deduction, and downward to allow for marginal taxes and insurance. Either way, it gets you in the ballpark.

The Premium version ($.99) offers a tool to calculate monthly savings from a refinance.

HOW WELL IT DOES IT

It does not calculate the net effect of mortgage interest deduction, which would be a more accurate accounting of true costs of a monthly payment. I.e., a tax deductible $1000 interest payment is the equivalent of a $700 non-tax deductible payment.

I cannot insert typical escrows (taxes and insurance), and there is no option for interest only mortgages, though those products have virtually disappeared post-housing crisis.

There is a somewhat irritating banner ad, but that is becoming the norm on these free apps.

The email function is nice, but the format could be better; I’d like to be email the am table.

PROS: It’s simple. It works. It’s customizable. It’s helpful in articulating money concerns. It’s useful.

CONS: Limited in certain situations. It is hard to find on iTunes. Many people say it frequently crashes; I have never had this problem.

CONCLUSION: It’s basically what you want, simple, without a lot of add-ons, but useful. If you get into conversations with your clients about costs, and benefit from ways of articulating the monthly costs of the project, it can be really valuable. It could use a few financial calculator extras, but for the most part you won’t find yourself wanting more. One of the more useful $0.00 apps.

SCORE: 85/100

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Handy Heat Gun

8067 All-Weather Flashing Tape

Reliable Crimp Connectors

View Comments

I don't know any builders who would ever need to calculate a loan for a client. The likelihood of any generic calculation program providing an accurate number for the client would be slim anyway. More importantly, we're builders not bankers - I don't want to handle anyone's finances but my own. I can see this being a good tool for a realtor but not for a builder.

Now, if you can find me an app that will calculate how much money I am making (or losing) per hour on the job...

DC

Understanding mortgage calculations and the financial aspects of construction projects is crucial for builders. It allows them to assess the feasibility of projects and effectively communicate the costs to clients. By being able to articulate the initial construction costs and ongoing operating costs, builders can provide a comprehensive financial picture to clients, making complex projects more manageable. While builders may involve bankers in the financing process, having a grasp of mortgage calculations helps maintain control and understanding of the transaction. This knowledge empowers builders to make informed decisions and effectively navigate the financial aspects of construction projects.